About Us

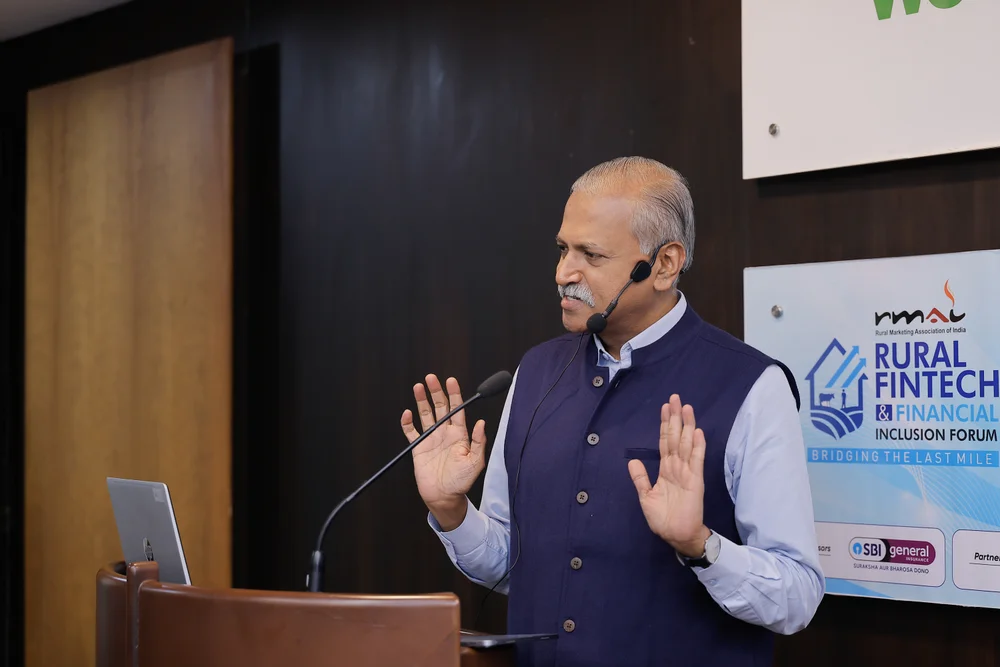

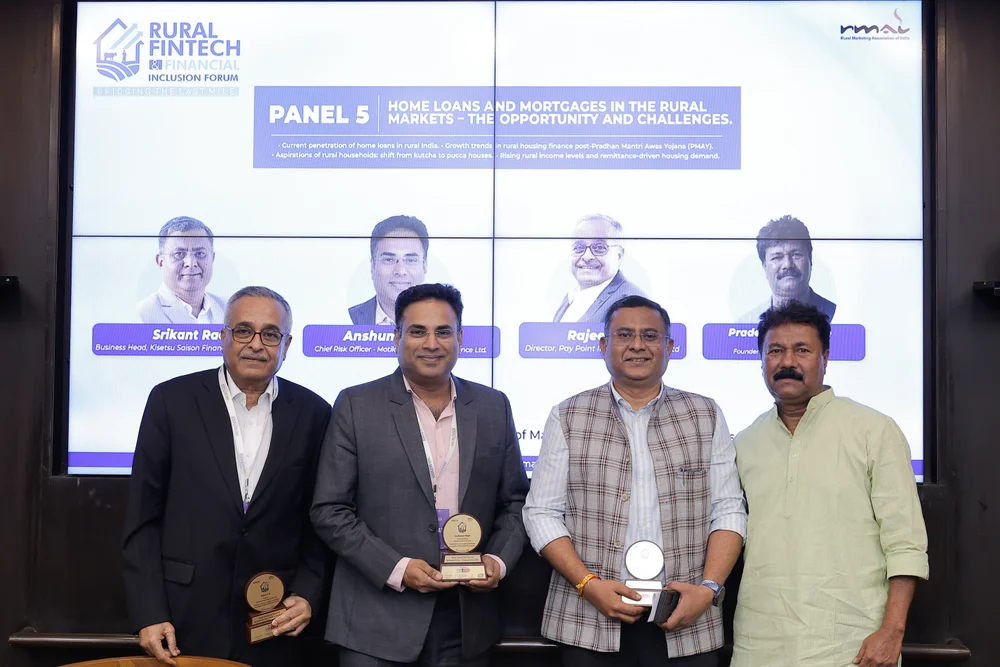

The Rural Fintech and Financial Inclusion Forum is a flagship platform designed by Rural Marketing Association of India, a premier and not-for-profit industry body devoted to furthering the cause of Rural Marketing in Asia to address one of the most pressing challenges of our time—building inclusive, technology-driven financial solutions for India’s rural economy.